The tax season due date has recently passed, and thus, the conversation has sprung regarding the importance of students at Camas High School (CHS) taking steps to ensure that they are fully equipped with the skills they will need in their adult life.

Financial Fitness teaches students how to make informed decisions on budgeting, investing, saving and managing debt. This is accomplished through a combination of classroom instruction, hands-on activities and real-world simulations. Students learn how to create and manage a budget, file their taxes and make wise spending choices.

“The class prepares students to understand what taxes are typically deducted from their paychecks. It also teaches them about social security taxes, Medicare, that kind of thing,” CHS economics teacher Stephen Short said.

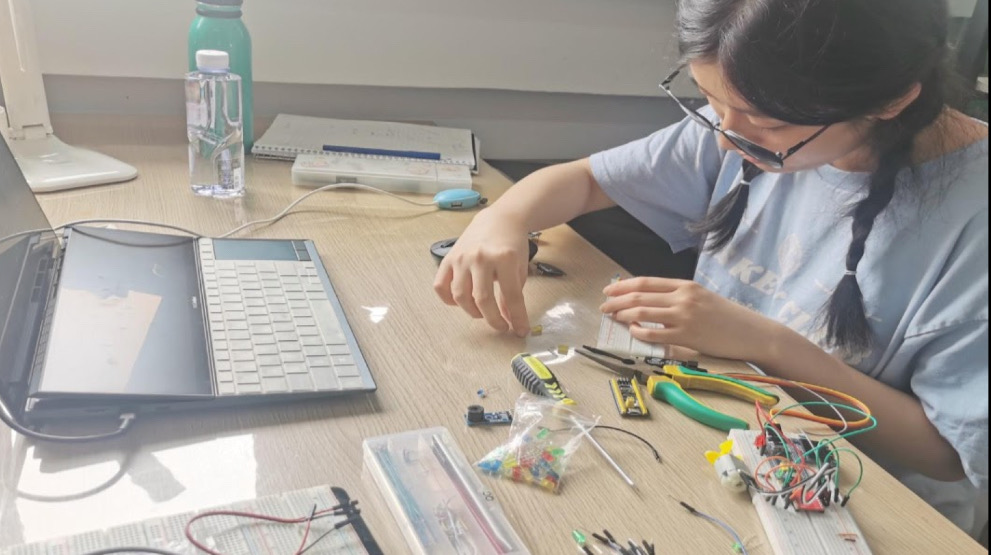

The class focuses on real-world applications. Rather than relying solely on textbooks, students participate in a wide range of hands-on activities.

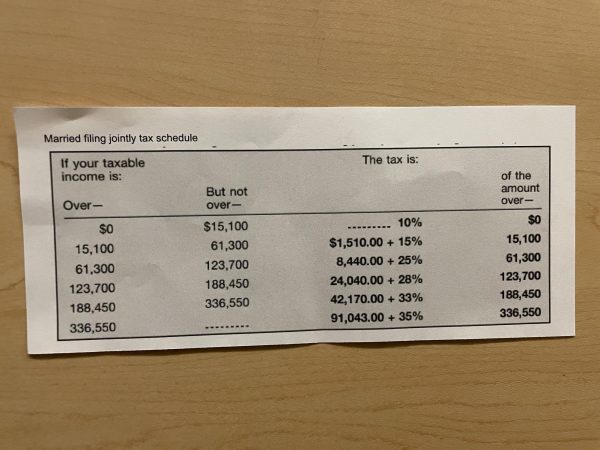

“We go through calculating taxes using tax schedules, tax worksheets and we do Turbotax simulations,” Short said. “Some of it is out of the book, and some of it we use online tools to simulate what it would be like in real life.”

Many people are unaware that taxes are very simple to do if their job utilizes a W-2 form. Using Turbotax or other online tax applications makes the process painless. Anyone who receives a paycheck and is classified as an employee by an employer qualifies as a W-2 employee.

In Financial Fitness, online simulations teach students how to use these tax preparation apps. Tax laws can be extensive and complex, which makes the entire process seem daunting to future taxpayers. Financial Fitness can help to alleviate these concerns and provide the guidance needed to navigate the taxation process as a whole.

Students who have taken the class found it to have many useful applications.

“It provides great teaching using real-world scenarios and lessons,” CHS senior Dalila Drugovich said.

Financial fitness is not just preparing students for graduation, but for their adult life. Through the class, students are encouraged to develop healthy financial habits early on, which sets them up for success in the future.