The Importance of Teaching Financial Literacy to High School Students

December 19, 2021

Camas High School (CHS) has countless unique classes available for students to take. However, a lot of people feel the importance of financial literacy is looked over in available coursework at the school. Many students at CHS do not know the importance of financial literacy, or the opportunities they have to learn about it.

The Financial Fitness teacher at CHS, Stephen Short said, “A lot of [students] financial security isn’t going to be about how much money they make, it will be about how they manage the money they make.”

The absence of these skills in their repertoire will only be disadvantageous to them. The inability to manage money could cause them to lose money, be in debt, or be forced to work past their 60’s. This means that many students are missing out on an opportunity that has the potential to change their future. “Money affects everybody. Every single person. Everybody needs to understand how to manage money. It’s just like reading, writing, any simple mathematics class, they need to understand how to manage money,” Short said.

“A lot of hardships come from mistakes made when we are young. I think [financial literacy] should be required for everybody. And I don’t know if a semester is enough or it should be a full year, but at minimum a semester where they can learn about credit,” Short said. “Students are going to graduate… they’re 18 years old, they’re old enough to get a credit card, and a lot of students don’t understand how they work and how to manage them, or they’re scared of them because somebody told them to stay away from credit cards.”

While CHS does not require students to take a financial literacy class, they do have some opportunities that many students are unaware of. “We used to do a Financial Reality Fair which we would like to do again. It got paused because of COVID, but annually we usually host a Financial Reality Fair where students go through a personal budgeting exercise. We are hopeful to be able to do that again,” Short said.

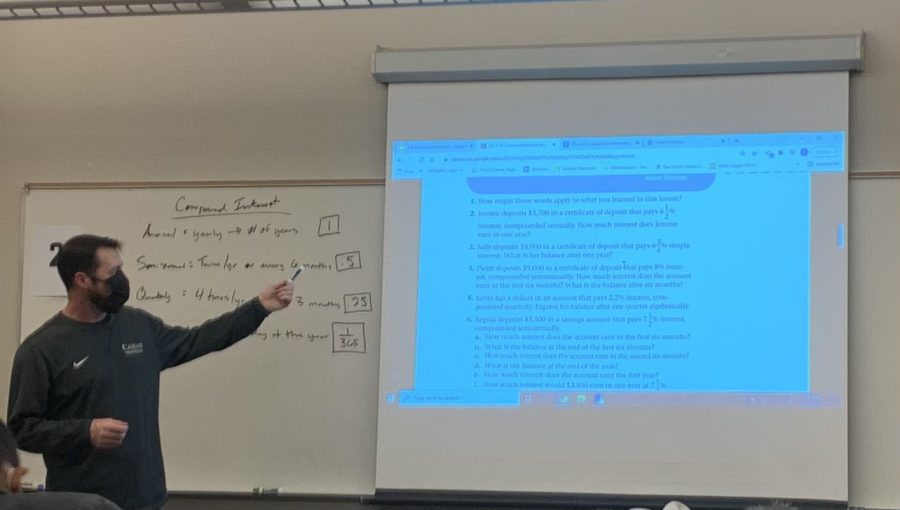

In addition to the Financial Reality Fair, CHS also offers a financial literacy class called Financial Fitness. Financial Fitness is a class that teaches students about important financial skills such as budgeting, banking, interest, the stock market, and how to establish, build, and maintain good credit.

“[We teach] all the things adults will experience and students will soon. Credit and interest. Those are the two big things. If you can understand those two things and you can understand how to budget, you’ll do ok,” Short said.

“I would encourage students to take this class, it’s called financial fitness, but it’s a personal finance class. Maybe we need to change the name, but I would encourage them if they are not able to take the class to educate themselves before they really get the full weight of the responsibility of managing their money themselves. Talk to somebody who knows something about it, talk to parents about it. It’s really important,” Short said.

Financial Fitness at CHS will give students the skills that they need to succeed in managing their money as adults. Whether or not students are inclined to take the class, it is important that they seek financial education from somewhere else.